Articles

Africa’s green H2 potential and market growth

H2 Hubs and Infrastructure

A. SHAHRUDDIN, Energy Industries Council (EIC) Asia Pacific, Kuala Lumpur, Malaysia

Africa’s strategic position and abundance of renewable resources have the potential to make the continent a major global producer and exporter of green hydrogen (H2) molecules. Dozens of projects have recently been announced but, as of this article’s publication date, none have reached the engineering, procurement and construction (EPC) stage.

The author’s company’s data show that while there are 41 proposed green H2 projects on the continent, construction has not begun for any of them. The company expects work to begin in at least one of the North African projects in 2025–2026.

North Africa nations, particularly Egypt, Algeria and Morocco, are leading the way in green H2 development. The region’s abundance of year-round sunshine and proximity to Europe make it an ideal location for large-scale H2 production and export. Egypt’s National Green Hydrogen Strategy exemplifies this ambition. According to this strategy, Egypt aims to control 8% of the global H2 market and produce up to 10 MMtpy of green H2 by 2050. A significant portion of this production will be destined for export as Egypt leverages its strategic location across the Mediterranean from Europe.

Europe’s REPowerEU Plan, which aims to reduce the continent’s dependence on Russian gas, has identified North Africa as a key supplier of green H2. Germany, Austria and Italy are proposing to repurpose 3,300 km of existing midstream gas infrastructure in North Africa to import 4 metric MMtpy of green H2.

North Africa’s solar irradiance levels are among the highest in the world, which make it particularly suitable for solar-powered electrolysis, the process by which green H2 is produced. The combination of high solar potential and existing gas infrastructure creates a unique opportunity for North Africa to become a hub for green H2 production and export. The region’s proximity to Europe also reduces transportation costs, making it a more attractive option compared to other potential suppliers.

Sub-Saharan Africa is also making significant steps in the development of green H2. For example, Namibia is home to a $10-B H2 project, led by Hyphen Hydrogen Energy, that is expected to produce 350,000 tpy of green H2 and create up to 15,000 construction jobs and 3,000 permanent positions.

Mauritania is another key player. The country’s Aman and Nour projects are expected to produce 40 GW of power dedicated to H2 production. These projects are a testament to the growing interest in green H2 across the continent, which is certainly driven by the need to diversify energy sources while also creating new economic opportunities, including thousands of jobs. In particular, the Aman project is expected to produce 1.7 MMtpy of green H2, with a significant portion destined for export to Europe.

Sub-Saharan Africa’s renewable energy potential is vast. Countries like Kenya and South Africa are investing heavily in solar and wind energy, in no small part to meet expected H2 demand. South Africa, for example, has 59 operational solar farms, making it a leader in solar capacity on the continent. The country’s Renewable Energy Independent Power Producer Procurement (REIPPP) program has been instrumental in attracting investment in renewable energy projects, which could serve as the foundation for green H2 production.

Despite the immense potential, the development of green H2 in Africa faces major obstacles. The upfront costs for green H2 initiatives are massive, with high capital investment in terms of pipelines, ports and export terminals. The author’s company’s recent “Africa OPEX Report” asserts that African countries should adopt better policy frameworks and regulatory support that are conducive to investment. Without them, the ramp-up of H2 production will be delayed.

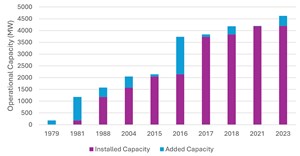

The lack of specific regulations is particularly clear in the energy storage sector. While Africa’s energy storage capacity has grown from 180 MW in 1979 to 4.2 GW in 2023 (FIG. 1), the sector still faces major obstacles. South Africa, which contributes 3.6 GW of this capacity, is a leader in this area, but more investment is needed across the continent to ensure that energy storage keeps pace with production.

Energy storage is critical for green H2 production, as it ensures a stable supply of renewable energy for electrolysis. Without adequate storage infrastructure, the intermittent nature of solar and wind energy can disrupt H2 production, making it less dependable for export markets. The development of large-scale battery storage systems and other energy storage technologies will be essential for the success of green H2 projects in Africa.

The author’s company’s report underscores the importance of international collaboration and financing initiatives to overcome these challenges. Europe’s REPowerEU Plan, which aims to import 10 metric MMtpy of green H2 from Africa, is a step in the right direction. However, more targeted funding and collaboration will be required to scale up H2 production in Africa.

International financial institutions such as the World Bank and the African Development Bank will play a critical role in providing the necessary funding for green H2 projects. These institutions can offer concessional loans, guarantees and other financial instruments to reduce the risk for private investors. Additionally, partnerships between African governments and international companies can help transfer technology and expertise, further accelerating the development of the green H2 sector.

The green H2 sector is closely tied to Africa’s broader renewable energy growth. The continent presently has 61.1 GW of operational renewable energy capacity, with significant investments in solar and wind projects. South Africa leads in solar capacity, with 59 operational solar farms, while North African countries like Egypt and Morocco are driving wind energy development, with 9 GW of wind capacity added to the grid as of 2024.

These renewable energy projects provide the foundation for green H2 production, as H2 is produced through the electrolysis of water using renewable electricity. The scalability of green H2 production in Africa is therefore linked to the continent’s ability to expand its renewable energy capacity and invest in energy storage solutions.

The integration of renewable energy and green H2 production also offers an opportunity to address some of Africa’s energy access challenges. Many parts of the continent still lack reliable access to electricity, and green H2 could provide a solution by enabling the storage and transport of renewable energy to remote areas. This could help bridge the energy gap and support economic development in underserved regions.

Next steps. To fully realize Africa’s green H2 potential, several key steps must be taken. First, African governments must develop clear policy frameworks and regulatory support to attract investment in green H2 projects. This includes setting targets for green H2 production, providing incentives for renewable energy development, and establishing clear guidelines for the use of existing infrastructure.

Second, international collaboration and financing will be critical to overcoming the upfront costs of green H2 projects. International financial institutions, development agencies and private investors must work together to provide the necessary funding and technical expertise to scale up H2 production in Africa.

Third, investments in energy storage and grid infrastructure will be essential to ensure a stable supply of renewable energy for H2 production. These include the development of large-scale battery storage systems, as well as upgrades to existing grid infrastructure to accommodate the increased demand for electricity.

Finally, partnerships between African governments, international companies and research institutions can help transfer technology and expertise. These partnerships can also help build local capacity and create a skilled workforce to support the growth of the industry.

In the end, realizing Africa’s green H2 potential will require major investments in infrastructure, clear policy frameworks and international collaboration. The author’s company’s report provides a roadmap for addressing these challenges. It stresses the need for targeted funding and regulatory support to scale up H2 production in Africa. As the global energy transition accelerates, Africa is undoubtably well-positioned to become a key player in the green H2 market, provided the necessary conditions are met. H2T

About the author

AQILAH SHAHRUDDIN is an energy analyst for operational and decommissioning assets covering the Middle East, Africa and CIS. Before joining the EIC, she completed her first degree in China followed by a master's degree in Malaysia. During her first year at EIC, Shahruddin authored a Middle East OPEX report in 2024 and delivered presentations in several webinars. She is committed to working with her team to enhance EICAssetMap as a trusted resource for EIC members.